There are few crimes that should be deemed unforgivable; the kind of violation that should be punishable by death, or at least an internship as Naomi Campbell's personal assistant. Among these crimes are forcing your girlfriend to meet your parents only to punk out and introduce her as your "best friend" or slipping a dress on your passed out butch friend so that you can upload the picture on her Facebook; ladies those are borderline hate crimes!

But the transgression that trumps all is definitely identity theft. I'm not talking about the getting-busted-wearing-your-girlfriend's-clothes kind of identity theft, an offense that can easily be remedied by exclusively dating super models. No, I'm talking about the take-your-social-security-number-and-run-up-credit-cards kind of identity theft. And it's more common than you might think.

According to the Federal Trade Commission, as many as 9 million Americans have their identities stolen every year. Most likely you or someone you know may have experienced some form of identity theft.

This crime occurs when someone uses your personal identifying information without your permission to commit fraud. Thieves can rent an apartment, open a bank account, apply for a loan or credit card, make fake checks using your account number or establish utilities in your name using this information.

I would love to say that I have an easy way to avoid becoming a victim, but just like with hot cougars, if they want your number, they'll find a way to get it. All you can do is minimize your exposure to these types of individuals and keep a close grip on your credit report. As for the hot cougars, that's another article.

And, of course, it wouldn't be one of my columns if I didn't tell you to start by taking advantage of the free access you have to your credit report. We may not be able to marry yet but by God we still get one free credit report a year from each of the three credit reporting agencies; Experian, Transunion and Equifax, at www.annualcreditreport.com.

Here are some ways your identity can be stolen as well as some suggestions on how to minimize the probability that you will be victimized.

Dumpster Diving

Oh, the things these thieves will do. They will literally rummage through dumpsters looking for bills, statements, credit card offers, or anything else that has your personal information on it. They have about as much shame as we all did in college.

This is a quick fix, though. You can buy a shredder for under $50 at Target. I recommend a crosscut shredder for extra security but really you just need something that will make a mess of all those pretty numbers that make you who you are.

Skimming

This is for the thieves with engineering degrees. These machines can read and record your credit or debit card number. Some of these devises can even record your PIN. This allows criminals to basically manufacture duplicate cards that will run up your credit or deplete your checking account.

Unfortunately, it's as difficult to spot these machines as it is to nail down the number of times a plot line in the L Word was forgotten (Wasn't Alice bisexual the first season before she dated that lesbian-identified male? That's enough to turn anyone gay!).

This is why it's important to try to limit your non-bank ATM usage. The ATMs outside your local branch are far less susceptible to tampering and are monitored more frequently by security than, say, gas station ATMs.

Since this type of identity theft is difficult to avoid, it's just another good reason to check your statements every month to detect any unauthorized activity. Most banks have identity theft protection on their cards. Look for $0 fraud liability so that you can get your money back after your fraud claim is filed.

Phishing

These are your theater drop outs turned identity thieves. These individuals contact you by phone, mail or email pretending to represent your financial institution or other company attempting to acquire your personal identifying information.

If you get a call from someone like this, do not give them your information. Just take down their employee identification number and the reason for their call and go to your local branch. If you don't have a local bank, you can call the toll free number and update your information that way. If you get a letter or email, don't send anything back with your information until you confirm that it is a valid correspondence. Don't just give it away for free, ladies, make them work for it!

more on next page...

\\\

(continued)

Address Changes

If they have enough information, they can even change your billing or statement address. This gives them a head start; by the time you realize you're not getting your statements, it can be too late.

As for your account statements, go green while protecting your identity. Most banks have online statements so that your mail isn't vulnerable to mail box burglars. You can save a tree or two in the meantime. Also, most major companies can send your bills to your email address.

I know what you are thinking. How would you know whether or not one of your bills didn't come? Um, because you have your due dates calendared, of course! And don't try to make excuses, either. Even the most basic cell phone has a calendar.

Stealing

Let's not forget about the pre-technology-age way of obtaining your personal information: stealing. Although being pick-pocketed is no picnic, it is yet another way to validate our love for wallet chains and cargo pockets. However, if Hot Topic is not in your regular mall trip rotation, just be careful what you keep in your wallet, purse, or, dare I say, fanny pack.

First off, your Social Security Card has no business in your wallet. I have faith that you can remember the same nine numbers that have identified you since birth. Only carry your social security card, passport or birth certificate when absolutely necessary.

Also, don't be one of those people who write their PIN on the back of their debit cards, that's just asking for it. Empty your wallet of extra IDs and cards you don't frequently use.

If you find out that your identity has been stolen by one of these or any other methods, file a police report, or more specifically, an Identity Theft Report. This can be used to permanently block fraudulent information and debts from your credit report. You should also file an ID Theft Complaint with the FTC to further help your case.

Next you should notify Experian, Equifax and Transunion. You will want to place a freeze or fraud alert on your credit report. Additionally, these agencies will work with you to start the long road of clearing your credit report of any and all inaccuracies.

You will then need to contact each institution you have credit or accounts with to alert them of the fraud and potentially reestablish your accounts. In extreme cases, you will need to request a new Social Security Number.

If your identity is stolen, and again, not like how 10 percent of the girls at the gay bars mysteriously have Shane's new haircut after every L Word season premier, you can potentially have a long road to repairing your credit. The best offense is a good defense, so keep a tight grip on your personal information before it's too late.

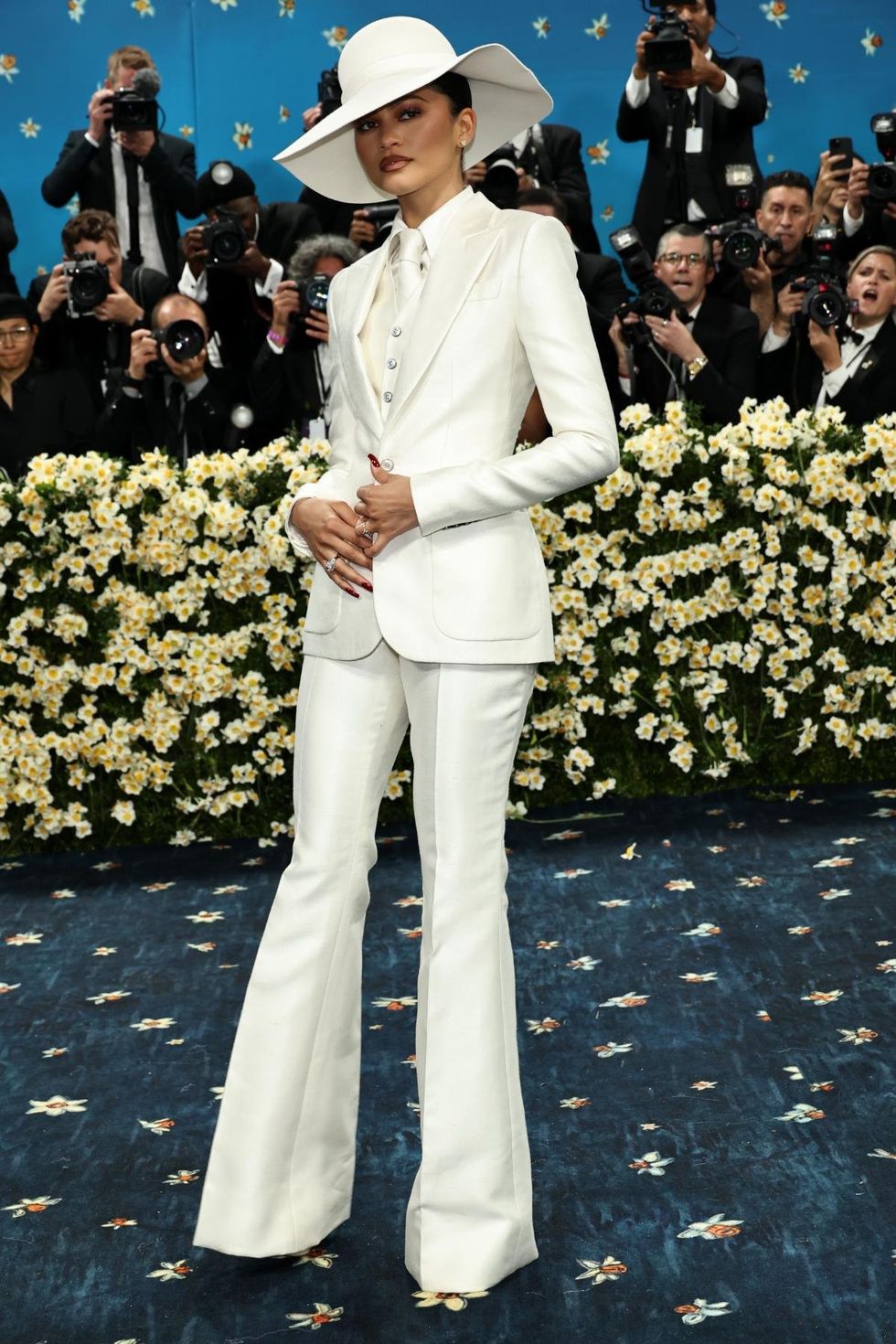

Cindy Ord/Getty Images

Cindy Ord/Getty Images